Corporate & Legal Counsel — Professional Law Firm

Near Medanta Hospital, Gurugram – 122003

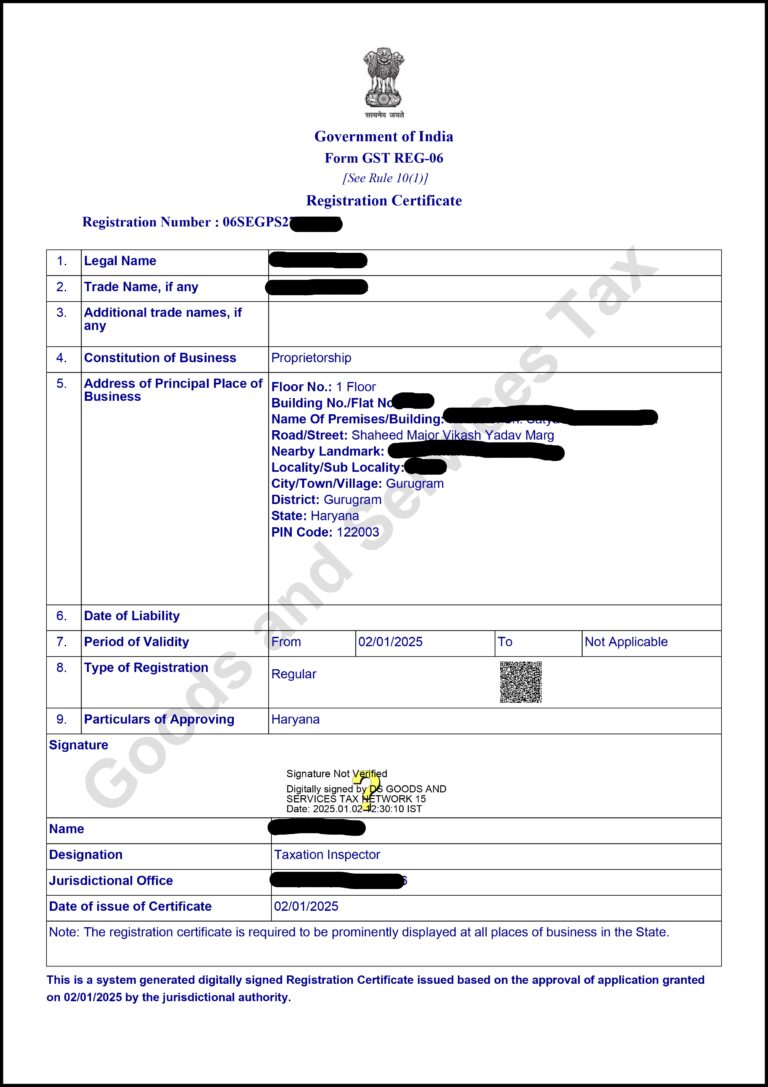

GST REGISTRATION

- 100% Online Process

- Well Qualified Team

- Fast & Quick Process

- Free Consultations Lifetime

- Limited Time Offer – Flat 40% Discount!

FEEL FREE TO CONTACT US

Goods and Services Tax (GST) is a pivotal tax reform in India, and GST registration is mandatory for businesses to comply with the law. Failure to register can lead to heavy penalties.

GST registration allows businesses to legally collect GST from clients and operate without legal hassles. At [Your Business Name], we simplify the GST registration process, ensuring a hassle-free experience.

Whether you’re in Delhi NCR, Mumbai, Bengaluru, Chennai, or anywhere in India, our expert team is here to guide you and help you obtain your GSTIN quickly and efficiently.

Get your GST registration done with ease today!

What is GSTIN?

GSTIN is a unique 15-digit alphanumeric code that is issued to every Firm/Company/Individual, who is enrolled under GST.

The government has assured that everything within GST is digital so that there is maximum transparency with less corruption.

The first 2 digits of the GSTIN mean the state code which is issued according to the 2011 census.

The next 10 digits are the PAN number of the entity.

The 14th digit is Z by default.

The 15th or the last digit is the Checksum digit. It comes, naturally, because of the figure of the calculation of the other 14 digits.

GST Registration Process on the Government Portal

Follow these steps to register for GST on the official portal:

- Visit the GST portal and select the Registration tab.

- Complete Part-A of Form GST REG-01 by providing your PAN, email ID, mobile number, and state.

- Verify via OTP to receive a temporary reference number.

- Fill Part-B of Form GST REG-01, sign using DSC or EVC, and upload required documents as per your business type.

- Upon approval, you’ll receive an acknowledgment in Form GST REG-02.

- If additional information is required, you’ll be notified via Form GST REG-03 and must respond within 7 days using Form GST REG-04.

- Applications with errors may be rejected in Form GST REG-05.

- Once verified, you’ll receive your GST registration certificate in Form GST REG-06.

Complete the process carefully to ensure smooth approval!

Benefits of GST Registration

- Unified Tax System

GST replaced multiple indirect taxes like excise, service tax, and VAT, simplifying the tax structure under a single system. - Cost Savings

Eliminating double taxation has reduced the overall cost of goods and services, enabling consumers to save more. - Ease of Doing Business

With the “One Nation, One Tax” policy, interstate business has become simpler and more efficient. - Reduced Tax Cascading

GST allows input tax credit at each stage of the supply chain, ensuring tax is only paid on value addition, reducing product costs. - Job Creation

Lower costs and higher demand have boosted production, leading to increased employment opportunities. - GDP Growth

Higher production driven by increased demand contributes to economic growth and a stronger GDP. - Reduced Tax Evasion

A streamlined system minimizes corruption and tax evasion by bringing multiple taxes under one umbrella. - Competitive Market

Lower logistics and interstate costs make goods more affordable and competitive in the market. - Increased Revenue

Higher demand and streamlined taxation have led to improved tax collections for both state and central governments.

Why Choose Filing Raasta ?

At Filing Raasta, we understand that compliance, registrations, and legal processes can often seem overwhelming and time-consuming for entrepreneurs, startups, and even established businesses. Navigating through requirements like GST registration, trademark filing, company incorporation, tax filings, or other regulatory obligations can take your focus away from running and growing your business. That is why Filing Raasta is dedicated to making these processes seamless, transparent, and completely hassle-free for you. With a strong team of experienced professionals and legal experts, we not only provide personalized guidance at every step but also ensure accuracy, efficiency, and quick turnaround times, saving you from the risks of delays, penalties, or errors in documentation. Our platform is designed to deliver reliable, cost-effective solutions that are easy to access and tailored to your unique business requirements, no matter the scale or industry you operate in. For startups, we act as a launchpad, handling crucial registrations and compliance so that founders can focus on innovation and expansion. For growing and established enterprises, we serve as a compliance partner, ensuring that all statutory obligations are met consistently while reducing administrative burdens. Beyond registrations, Filing Raasta empowers businesses with timely updates, reminders, and compliance insights, helping them stay ahead of regulatory changes and avoid unnecessary hurdles. What sets us apart is not only our expertise and professionalism but also our commitment to simplifying legal complexities into a smooth, user-friendly experience. By choosing Filing Raasta, you are not just availing a service—you are choosing peace of mind, expert support, and a dependable partner invested in your long-term success. Trust Filing Raasta to handle your registrations, tax filings, and compliance needs with precision while you dedicate your valuable time and energy to scaling your business, reaching new markets, and achieving sustainable growth.

Disclaimer:

Filing Raasta is a service platform that provides assistance with business registrations, compliance, tax filings, and related professional services. The information provided on our website, brochures, and promotional materials is for general informational purposes only and should not be considered as legal, tax, or financial advice.

Frequently Asked Questions (FAQs) for RERA CASES

GST registration is required to legally collect GST from customers and pass input tax credit. It ensures compliance with Indian tax laws and allows businesses to operate smoothly without legal penalties.

Businesses whose turnover exceeds the prescribed threshold, those involved in inter-state supply, e-commerce sellers, and certain service providers must obtain GST registration, regardless of turnover.

GST registration enables businesses to claim input tax credit, expand operations across India, participate in government tenders, and build credibility with clients, vendors, and financial institutions.

A business can operate without GST registration only if it falls below the threshold limit and does not engage in mandatory categories. Operating without GST when required may attract heavy penalties and legal action.

GST registration enhances business transparency, improves customer trust, allows seamless inter-state trade, and helps businesses scale by working with larger clients who require GST-compliant vendors.

Yes. Online sellers, e-commerce operators, and service providers supplying goods or services through online platforms are required to obtain GST registration, irrespective of their turnover.

Basic documents include PAN, Aadhaar, address proof of business place, bank account details, photographs of the proprietor/partners/directors, and business registration documents.

GST registration is usually granted within 3–7 working days, subject to successful Aadhaar authentication and verification by the GST department.